The Week Ahead

This week the markets will no doubt be reactive to geopolitical news - Ukraine. On deck this week are earnings the following will be of...

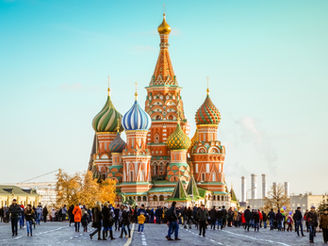

Inflation, Fed Tightening, War in Europe = Volatility

As the world cranks up sanctions against Russia, far too slowly and far too weak, fear grows that inflation, already at running at its...

Airlines Sinking over Canceled Flights

U.S. stocks are moving up at the open today, December 27th. But there should be caution because lower liquidity can amplify market moves...